AERAMENTUM RESOURCES

Exploration & Development of High Grade Gold, Copper and Cobalt Projects

AERAMENTUM RESOURCES

About Aeramentum

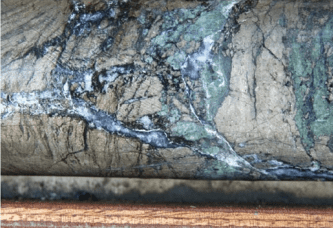

Aeramentum Resources Ltd (AEN) is the owner of tenements in the Republic of Cyprus, which have past copper mining and drilling undertaken, both during ancient times and as recently as 2014. With grades up to 3% cobalt, 18% copper, 17g/t Au and 11% nickel reported in previous exploration (adits, drilling and surface sampling) the first target orebody at Laxia remains open at depth and along strike, and daylights in many places at surface.

Aeramentum recently entered into an Exclusivity Agreement regarding an Option to acquire a high grade copper-gold (IOCG) project in Chile, South America. With reported gold grades of up to 260g/t, copper grades up to 10% and cobalt up to 0.4%, Aeramentum is looking to pursue both near-term production and drilling to test the IOCG theory.

$TBA

Three Resources Players with Elevated Focus on ESG & Sustainability

history

Cyprus Project History

During the period of the Roman Empire, Cyprus supplied much of the world’s copper requirements, however after the Roman Empire, copper mining on the island became dormant.

Modern mining commenced in Cyprus in the 1920s with more than 74 million tonnes of massive sulphide ore extracted from about 30 deposits in the following 50 years. Mostly open cut.

The Political turmoil in the 1970s put an end to mining on the island, however it restarted in the 1990s and both copper and gold mining has occurred since (albeit on a smaller scale).